How to Obtain MEPCO Electricity Tax Certificate Online

The Multan Electric Power Company (MEPCO) serves a large number of residents and businesses in southern Punjab, Pakistan, with the provision of electricity. All consumers have electricity bills from which a deduction termed as “electricity tax” is taken. This deduction is, in an actual sense, a withholding tax that is recouped on behalf of the government. Consumers need the MEPCO Tax Deduction Certificate (also popularly known as an MEPCO tax) for tax compliance and to claim tax credits. MEPCO Electricity Tax is a standard withholding tax that is taken regularly from the monthly electricity bills of all consumers. It collects this amount and deposits it with the Federal Board of Revenue (FBR). Deduction applies to all consumers, whether commercial or industrial.

This tax is primarily for simplification of tax collection from utility consumption, with the benefit for taxpayers to use tax credits across their other total income liability at a later date against total income tax liability. This is regarded as official evidence of all taxes deducted in one financial year. This certificate is useful to taxpayers who are filing returns on the FBR’s tax portal (IRIS). MEPCO tax education helps the consumers with financial assurance against being double-taxed. Instead, it enables them to claim a bona fide tax refund or tax credit.

Who is Eligible for the MEPCO Tax Deduction Certificate?

All MEPCO consumers are eligible for it if their electricity bills show a deduction of the electricity tax. Generally, it includes commercial consumers like shops, offices, and factories; industrial consumers whose electricity demand is above the standard and residential consumers, sometimes where tax is applicable. Consumption levels as implied by billing policies and under FBR guidelines determine the amount of it deducted. Generally speaking, the tax deduction certificate covers the whole amount deducted for the last financial year (1 July to 30 June).

Ways to Get the MEPCO Tax Deduction Certificate

Two main ways of receiving:

1. From Your July Electricity Bill:

Traditionally, MEPCO gives the tax deduction card with the July electricity bill every year. This bill would have a section or page dedicated to showing the total tax deducted in the previous financial year. This should be saved for the tax return.

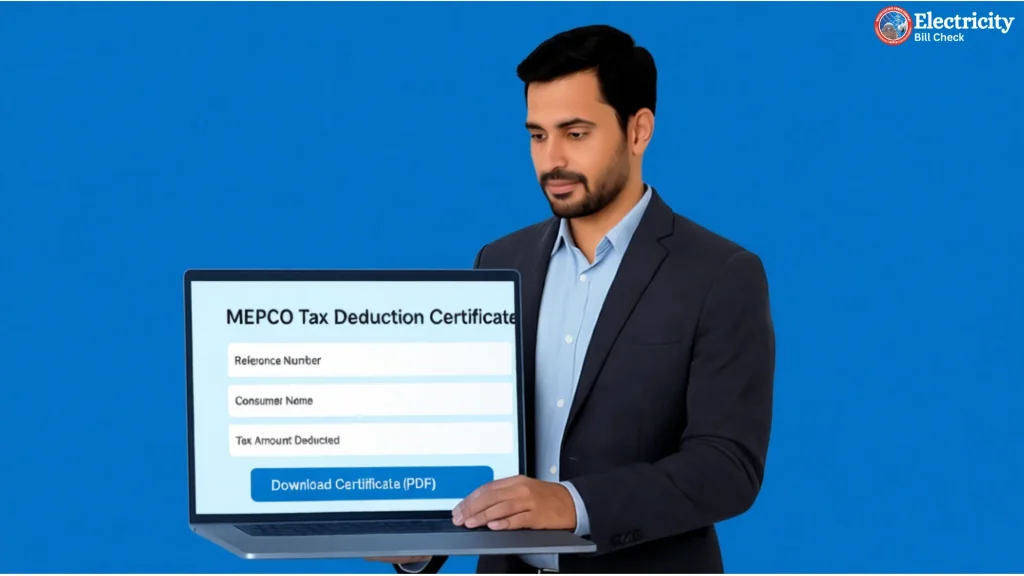

2. Online Download via PITC Web Bill Portal:

An even simpler and accessible means to acquire the use of the PITC web portal is to download it online.

Go to:

- Open the PITC Web Bill Portal.

- Choose “Multan Electric Power Company (MEPCO)” from the list.

- Enter your Reference Number (14 digits) or Customer ID (10 digits) from your electricity bill.

- Choose the appropriate “U” or “R” option as necessary.

- Then, click “Search” to view your bill details.

- Click on “Tax Certificate” in the right-hand corner.

- Download & save it in PDF format: An official MEPCO Tax Deduction Certificate. This digital certificate is recognized by FBR and is likely to be presented with annual income tax returns.

Key Highlights Included in the MEPCO Tax Certificate

- The name of the consumer as well as the electricity account details.

- Reference or customer ID for the bill prepared by the consumer.

- Total electricity tax amount deducted during the last financial year (July to June).

- Tax withheld monthly during that billing period.

- Signature and stamp of MEPCO/PITC authenticity.

- Owing to these details, taxpayers can have their proof for exact amounts being withheld against income tax returns concerning the FBR to evade double taxation.

Using the MEPCO Tax Certificate for FBR Tax Returns

The taxpayer would upload or declare as proof of withholding tax paid when filing tax returns through the FBR IRIS portal. The certificate would serve for the following purposes:

- Proof of tax deducted in advance;

- Credit for taxes withheld against total income taxes; and

- Less risk of penalties/tax notices due to unpaid utility taxes.

- Taxpayers should keep that certificate for neatness and the electricity bills for smooth access to tax filing and later reference.

MEPCO Electricity Tax and Its Effects on Monthly Bills

This was deducted from individual monthly electricity consumption, appearing under a separate line item in MEPCO bills as withholding tax deducted under Section 235 of the Income Tax Ordinance. This affects:

- The total bill amount that is payable by consumers.

- The advance tax amount is collected on behalf of the government by MEPCO every month.

- Tax credit eligibility or even a refund upon tax return filing.

- A consumer could thus relate tax components to better manage their finances and even bring spending within the expected annual tax obligations.

Importance of MEPCO Tax Certificate in Commercial and Industrial Proceedings

Commercial and industrial consumers have high consumption of electricity, which in turn means high amounts of tax deduction. This is important for these entities. Makes them file income tax returns and claim a prudent tax credit for the paid. Complies with the tax law about withholding tax. Avoid double taxation and penalties on under-reporting. Collection and verification, therefore, of MEPCO tax certificates should form part of annual accounting and tax compliance by businesses.

Conclusion

In Pakistan, where these provisions apply, it is essential to obtain the MEPCO electricity tax deduction certificate because taxpayers who pay electricity tax through the MEPCO bills require this document. An official site, therefore, provides evidence of electricity tax deduction in a given financial year, making it significant when filing returns on income tax and even claiming tax credit with FBR. Consumers use this certificate by obtaining it from their July bill or downloading it online from the PITC portal, either using their MEPCO reference number or customer ID. Understanding its timely acquisition and effective use will significantly assist in achieving compliance with regulations and optimizing tax payments.